How To Spread A Blog

Vertical Spreads Explained: The Ultimate Guide

Vertical spreads are the most basic options strategies that serve as the building blocks for more complex strategies.

Traders can use vertical spread options strategies to profit from stock price increases, decreases, or even sideways movements in the share price.

In this comprehensive guide, we'll cover everything you need to know about trading verticals.

What is a Vertical Spread?

A vertical spread is an options strategy constructed by simultaneously buying an option and selling an option of the same type and expiration date, but different strike prices. A call vertical spread consists of buying and selling call options at different strike prices in the same expiration, while a put vertical spread consists of buying and selling put options at different strike prices in the same expiration. Vertical spreads can be bullish or bearish.

Consider the following example:

| June 2018 Call Options | ||

|---|---|---|

| Strike Price | Buy/Sell | Quantity |

| 150 | Buy | 1 |

| 175 | Sell | 1 |

In the above example, a trader is buying one contract of the 150 call while also selling one contract of the 175 call. Both call options are in the June 2018 expiration cycle.

The trade is considered a call vertical spread because the trader is buying and selling call options that are in the same expiration cycle but have different strike prices.

Vertical Spread

A category of options strategies that are constructed with two options at different strike prices in the same expiration cycle. One option is purchased and the other option is sold.

In the next sections of this guide, we'll cover the four types of vertical spreads:

✓ The Bull Call Spread

✓ The Bear Call Spread

✓ The Bear Put Spread

✓ The Bull Put Spread

We'll show you how to set them up and when to trade them, as well as look at some expiration payoff diagrams and performance visualizations of real trade examples.

In the following examples, we'll start by focusing on the directional aspect of each strategy. After covering each of the strategies, we'll discuss more advanced topics such as how time decay and implied volatility play a role in the profitability of each strategy.

Let's dive in!

The Bull Call Spread Strategy

The bull call spread is, you guessed it, a bullish vertical spread constructed with call options. Bull call spreads are also commonly referred to as long call spreads, call debit spreads, or simply buying call spreads.

For a quick explanation of the strategy, check out Investopedia's guide here.

In this guide, we'll cover the strategy in great detail. Let's start with the strategy's basic characteristics:

| How to Set Up the Trade |

|---|

| Buy a call option and simultaneously sell another call option at a higher strike price. Both options need to be in the same expiration cycle. |

| How the Strategy Profits |

| Bull call spreads make money when the share price increases, as the call spread's value rises with the share price (all else being equal). Ideally, the stock price rises to the short call's strike price by expiration. |

| When to Buy Call Spreads |

| Traders buy call spreads when they believe a stock's price will increase, but not necessarily to a price higher than the strike price of the call that is sold. |

| Breakeven & Profit/Loss Potential |

| Breakeven Price = Long Call's Strike Price + Premium Paid Maximum Profit Potential = (Spread Width - Premium Paid) x $100* Maximum Loss Potential = Premium Paid x $100* |

*These calculations assume the options are standard equity options with a contract multiplier of $100. If the traded options have a contract multiplier different from $100, swap out $100 for the correct multiplier.

To fully understand the strategy's characteristics mentioned above, let's walk through a real long call spread example using Facebook (FB) options from 2017.

Bull Call Spread Example

Here are the details of the bull call spread we're going to analyze:

| Stock Price at Entry: $142.28 |

|---|

| Call Strikes & Prices: Buy the 135 Call for $9.30; Sell the 150 Call for $1.54; Both options expire in 46 days. |

| Spread Entry Price: $9.30 Paid - $1.54 Received = $7.76 Premium Paid |

| Breakeven Price: $135 Long Call Strike + $7.76 Premium Paid = $142.76 |

| Maximum Profit Potential: ($15 Spread Width - $7.76 Premium Paid) x $100 = $724 |

| Maximum Loss Potential: $7.76 Premium Paid x $100 = $776 |

Let's hammer these points home by visualizing the position's expiration payoff diagram:

Now, to make sure you understand these expiration profits/losses, let's walk through each important price zone for this specific bull call spread position:

| Maximum Profit Potential |

|---|

| Stock Price(s): At or above the short call's strike price of $150. Why?: At any price equal to or above $150, the 135 call will be worth $15 more than the 150 call at expiration. Therefore, the 135/150 call spread will be worth $15, translating to a $7.24 gain per spread ($724 profit per spread) since the initial purchase price was $7.76. |

| $0 Breakeven |

| Stock Price(s): $142.76 at expiration. Why?: At $142.76, the long 135 call will be worth $7.76 at expiration, while the short 150 call will expire worthless. As a result, the 135/150 call spread will be worth $7.76, which is the same as the initial purchase price. |

| Maximum Loss Potential |

| Stock Price(s): At or below the long call's strike price of $135. Why?: At any price below $135 at expiration, the 135 call and the 150 call will both expire worthless since they will be out-of-the-money. As a result, the net value of the 135/150 call spread will be $0.00, which translates to a $7.76 loss per spread ($776 in actual losses per spread) because the spreads were purchased for $7.76. |

How Did the Trade Actually Perform?

The expiration payoff graph only tells us part of the story...

The spread's value (and therefore the profits and losses on the trade) will fluctuate as the share price changes on a daily basis.

With that said, let's take a look at what happened to this FB call spread as the share price changed between the entry date of the trade and the spread's expiration date:

In the first few days of this trade, FB shares fell, resulting in small losses on the long 135/150 call spread.

Fortunately, the price of the stock surged higher, which resulted in an increase in the call spread's value (and therefore profits for the buyer of the spread).

At expiration, the share price was at $148.06, which resulted in a net profit of $530 per call spread.

But why?

With FB shares at $148.06 at the time of expiration, the long 135 call expired to a value of $13.06 ($148.06 Stock Price - $135 Long Call Strike), while the short 150 call expired worthless. As a result, the net value of the long 135/150 call spread at expiration is $13.06.

Net P/L: ($13.06 Expiration Value - $7.76 Premium Paid) x $100 = +$530 per spread .

Bull Call Spread

A bullish call spread constructed by purchasing a call option and selling another call option at a higher strike price (same expiration cycle). The maximum profit occurs when the share price is equal to or above the short call's strike price at expiration, while the maximum loss occurs when the stock price is below the long call's strike price at expiration.

In short, traders who buy call spreads want the share price to rise, ideally to a price equal to or greater than the short call's strike price by expiration.

Need an Options Trading Account?

If you're in need of a brokerage account for options trading, check out tastyworks, our preferred broker.

tastyworks has a user-friendly trading platform and trader-friendly fees. If you open/fund your first tastyworks account and apply the referral codePROJECTOPTION, we'll give you full access to our exclusive options trading course (normally $497).

Click the button below to learn more about tastyworks and this offer.

The Bear Call Spread Strategy

Thebear call spread is a bearish vertical spread strategy constructed with two call options in the same expiration cycle. The strategy is also commonly referred to as a short call spread, call credit spread, or simply selling a call spread. Read Investopedia's quick guide on the bear call spread strategy.

When you sell a call spread, you're betting against an increase in the price of the stock.

Here are the strategy's general characteristics:

| How to Set Up the Trade |

|---|

| Sell a call option and simultaneously buy another call option at a higher strike price. Both options need to be in the same expiration cycle. |

| How the Strategy Profits |

| Bear call spreads make money when the share price decreases (since call prices fall when the share price decreases, all else equal), or as time passes with the share price below the breakeven price. |

| When to Sell Call Spreads |

| Traders sell call spreads when they believe a stock's price will decrease or trade sideways through the expiration date of the spread. |

| Breakeven & Profit/Loss Potential |

| Breakeven Price = Short Call's Strike Price + Premium Paid Maximum Profit Potential = Premium Received x $100* Maximum Loss Potential = (Spread Width - Premium Received) x $100* |

*These calculations assume the options are standard equity options with a contract multiplier of $100. If the traded options have a contract multiplier different from $100, swap out $100 for the correct multiplier.

Let's take a look at some visuals so you can better understand the metrics from the table above!

Bear Call Spread Example

For our bear call spread example, we'll turn to real option data in Apple (AAPL) from 2017.

Here are the specific details of the trade we'll visualize:

| Stock Price at Entry: $141.46 |

|---|

| Call Strikes & Prices: Sell the 142 Call for $1.93; Buy the 145 Call for $0.87; Both options expire in 32 days. |

| Spread Entry Price: $1.93 Received - $0.87 Paid = $1.06 Received |

| Breakeven Price: $142 Short Call Strike + $1.06 Premium Received = $143.06 |

| Maximum Profit Potential: $1.06 Premium Received x $100 = $106 |

| Maximum Loss Potential: ($3 Spread Width - $1.06 Premium Received) x $100 = $194 |

Tables are cool, but nothing beats a nice expiration payoff graph to visually represent an option strategy's profit and loss potential:

| Maximum Profit Potential |

|---|

| Stock Price(s): At or below the short call's strike price of $142. Why?: At any price equal to or below $142, the 142 call and 145 call will both expire worthless. As a result, the net value of the 142/145 call spread will be $0.00, which translates to a $1.06 gain per spread ($106 in actual profits per spread) because the call spreads were initially sold for $1.06. |

| $0 Breakeven |

| Stock Price(s): $143.06 at expiration. Why?: At $143.06, the short 142 call will be worth $1.06, while the 145 call will expire worthless. As a result, the net value of the 142/145 call spread will be $1.06, which is the same price the spread was sold for initially. |

| Maximum Loss Potential |

| Stock Price(s): At or above the long call's strike price of $145. Why?: At any price equal to or above the long call's strike price of $145 at expiration, the short 142 call will be worth $3.00 more than the long 145 call. As a result, the 142/145 call spread will be worth $3.00. With an initial sale price of $1.06, the loss per spread is $1.94 ($194 in actual losses per spread). |

How Did the Trade Actually Perform?

Ok, now that we've discussed the potential outcomes for this AAPL call spread at expiration, let's see what actually happened to the position over time:

At the time of entering the short 142/145 call spread, AAPL shares were trading just over $141.

Shortly after selling the call spread, AAPL shares surged higher to $145, which means the short call spread was almost entirely in-the-money (ITM).

As a result, the price of the call spread increased, which translated to losses for any traders who had sold that spread for $1.06.

Fortunately, AAPL headed lower and was trading for $142.06 per share at the time of the call spread's expiration date. At $142.26, the short 142 call was worth $0.26 while the long 145 call expired worthless.

The end result? The short 142/145 call spread is worth $0.26 at expiration, translating to $80 in profits for any trader who initially sold the spread for $1.06:

Net P/L: ($1.06 Spread Sale Price - $0.26 Spread Expiration Price) x $100 Option Contract Multiplier = +$80 Profit Per Spread.

Bear Call Spread

A bearish call spread constructed by selling a call option while simultaneously buying another call option at a higher strike price (same expiration cycle).

The maximum profit potential is realized when the share price is below the short call's strike price at expiration, while the maximum loss potential is realized when the share price is above the long call's strike price at expiration.

In short, sellers of call spreads want the share price to fall or trade sideways as time passes, as both of these events will lead to a decrease in the price of the spread, and therefore profits for the call spread seller.

For more on this options strategy, be sure to check out our ultimate guide on the bear call spread strategy.

Congratulations! You've just learned the two call spread strategies! Both of these strategies will always have a place in your options trading arsenal.

In the next two sections, we'll walk through both of the put spread strategies.

The Bear Put Spread Strategy

The bear put spread is a vertical spread options strategy used by traders who believe a stock's price will fall (they're bearish). The position consists of buying a put option while also selling another put option at a lower strike price in the same expiration.

When a trader buys a put spread, they're betting the stock price will decrease.

Bear put spreads are also commonly referred to as long put spreads, put debit spreads, or simply buying a put spread. For a quick run-down of the strategy, check out Investopedia's concise guide on the bear put spread.

In this guide, we're going to cover every detail you need to know about the strategy. Let's start by looking at the strategy's general characteristics and then hop into some trade examples:

| How to Set Up the Trade |

|---|

| Buy a put option and simultaneously sell another put option at a lower strike price. Both options need to be in the same expiration cycle. |

| How the Strategy Profits |

| Bear put spreads make money when the stock price falls (since the put spread's value will increase), all else being equal. |

| When to Buy Put Spreads |

| Traders buy put spreads when they believe a stock's price will fall, but not necessarily to a price lower than the short put's strike price. |

| Breakeven & Profit/Loss Potential |

| Breakeven Price = Long Put's Strike Price - Premium Paid Maximum Profit Potential = (Spread Width - Premium Paid) x $100* Maximum Loss Potential = Premium Paid x $100* |

*These calculations assume the options are standard equity options with a contract multiplier of $100. If the traded options have a contract multiplier different from $100, swap out $100 for the correct multiplier.

Let's check out a long put vertical in AMZN from 2016.

Bear Put Spread Example

Here are the trade details of our particular bearish put spread:

| Stock Price at Entry: $780.22 |

|---|

| Put Strikes & Prices: Buy the 800 Put for $44.88; Sell the 750 Put for $22.63; Both options expire in 59 days. |

| Spread Entry Price: $44.88 Paid - $22.63 Received = $22.25 Paid |

| Breakeven Price: $800 Long Put Strike Price - $22.25 Premium Paid = $777.75 |

| Maximum Profit Potential: ($50 Spread Width - $22.25 Premium Paid) x $100 = $2,775 |

| Maximum Loss Potential: $22.25 Premium Paid x $100 = $2,225 |

In this example, AMZN shares are at $780.22 when a trader buys the 800 / 750 put spread expiring in November of 2016.

The spread will be maximally profitable if AMZN shares are below the short put's strike price of $750 at expiration.

Conversely, the trader will lose the entire premium paid if AMZN shares are above the long put's strike price of $800 at expiration:

Let's dive into the specifics of why these expiration profits/losses are the way they are:

| Maximum Profit Potential |

|---|

| Stock Price(s): At or below the short put's strike price of $750. Why?: At any price equal to or below $750, the 800 put will be worth $50 more than the 750 put at expiration, which means the 800/750 put spread will be worth $50. With an initial purchase price of $22.25, the gain per spread is $27.75 ($2,775 in actual profits per spread). |

| $0 Breakeven |

| Stock Price(s): $777.75 at expiration. Why?: At $777.75, the long 800 put will be worth $22.25, while the short 750 put will expire worthless. As a result, the net value of the 800/750 put spread will be $22.25, which is the same price the spread was purchased for initially. |

| Maximum Loss Potential |

| Stock Price(s): At or above the long put's strike price of $800. Why?: At any price above $800 at expiration, the 800 put and the 750 put will both expire worthless since they will be out-of-the-money. As a result, the net value of the 800/750 put spread will be $0.00, which translates to a $22.25 loss per spread (a loss of $2,225 per spread in actual losses) because the spreads were purchased for $22.25. |

How Did the Trade Actually Perform?

Alright, we've gone through the potential outcomes at expiration, but what about when AMZN shares fluctuation over time?

Here's how this put vertical spread performed over time:

Ouch! At first, AMZN shares rallied from around $780 all the way up to $850, which translated to losses for the long put spread trader as the spread lost value.

At one point, the 800 / 750 put spread's price fell to $10, which represents a $1,225 loss per spread for the trader who purchased the spread for $22.25:

($10 Spread Value - $22.25 Purchase Price) x $100 Option Contract Multiplier = -$1,225 .

Fortunately, with AMZN shares trading for $760.16 at expiration, the long 800 put was worth $39.84 ($800 Put Strike Price - $760.16 Stock Price), while the short 750 put expired worthless.

As a result, the final value of the long 800 / 750 put spread is $39.84, which translates to a $17.59 profit per spread (in option terms):

$39.84 Spread Expiration Value - $22.25 Spread Purchase Price = $17.59 Spread Profit.

$17.59 Profit Per Spread x $100 Option Contract Multiplier = +$1,759 Total Profit.

Bear Put Spread

A bearish put spread constructed by buying a put option while simultaneously selling another put option at a lower strike price (same expiration cycle).

The maximum profit potential is realized when the stock price is below the short put's strike price at expiration, while the maximum loss potential is realized when the stock price is above the long put's strike price at expiration.

In short, buyers of put spreads want the stock price to fall to a price equal to or greater than the short put's strike price, as the put spread's price will approach its maximum potential value.

The Bull Put Spread Strategy

We've covered a ton of content already, but we've still got one more strategy to discuss before moving on.

The bull put spread strategy is a bullish vertical spread constructed by selling a put option while also buying another put option at a lower strike price in the same expiration.

You may also hear traders refer to the bull put spread strategy as a short put spread, put credit spread, or simply selling a put spread.

For a quick explanation of the strategy, be sure to take a look at Investopedia's concise guide on the bull put spread.

In this guide, we're going to cover the strategy in detail. Let's take a look at the strategy's general characteristics and then dive into a real trade example in Netflix (NFLX):

| How to Set Up the Trade |

|---|

| Sell a put option and simultaneously buy another put option at a lower strike price. Both options need to be in the same expiration cycle. |

| How the Strategy Profits |

| Bull put spreads make money when the stock price increases (since the put spread's value will fall, all else equal), or as time passes with the stock price above the strike price of the put that is sold. |

| When to Sell Put Spreads |

| Traders sell put spreads when they believe a stock's price will rise or trade sideways through the expiration date of the put spread. |

| Breakeven & Profit/Loss Potential |

| Breakeven Price = Short Put's Strike Price - Premium Received Maximum Profit Potential = Premium Received x $100* Maximum Loss Potential = (Strike Width - Premium Received) x $100* |

*These calculations assume the options are standard equity options with a contract multiplier of $100. If the traded options have a contract multiplier different from $100, swap out $100 for the correct multiplier.

Let's visualize this table by looking at an expiration payoff diagram and trade performance visualization of a real short put spread in NFLX.

Bull Put Spread Example

In the following example, we'll examine a short put spread in NFLX that experiences both profits and losses over the duration of the trade.

Here are the specific trade details:

| Stock Price at Entry: $146.92 |

|---|

| Put Strikes & Prices: Sell the 145 Put for $6.60; Buy the 135 Put for $3.07; Both options expire in 46 days. |

| Spread Entry Price: $6.60 Received - $3.07 Paid = $3.53 Received |

| Breakeven Price: $145 Short Put Strike Price - $3.53 Premium Received = $141.47 |

| Maximum Profit Potential: $3.53 Premium Received x $100 = $353 |

| Maximum Loss Potential: ($10 Spread Width - $3.53 Premium Received) x $100 = $647 |

As always, we'll explain the profit and loss potential and directional bias with a visualization of the expiration payoff diagram:

Here's an explanation of the key price levels on this expiration P/L graph:

| Maximum Profit Potential |

|---|

| Stock Price(s): At or above the short put's strike price of $145. Why?: At any price equal to or above $145 at expiration, the 145 put and 135 put will both expire worthless. As a result, the net value of the 145/135 put spread will be $0.00, translating to a $3.53 gain per spread ($353 in actual profits per spread) since the spread was initially sold for $3.53. |

| $0 Breakeven |

| Stock Price(s): $141.47 at expiration. Why?: At $141.47, the short 145 put will be worth $3.53 at expiration, while the long 135 put will expire worthless. As a result, the net value of the 145/135 put spread will be $3.53, which is what was initially collected for the spread. |

| Maximum Loss Potential |

| Stock Price(s): At or below the long put's strike price of $135. Why?: At any price below $135 at expiration, the short 145 put will be worth $10 more than the long 135 put, which means the 145/135 put spread will be worth $10. With an initial sale price of $3.53, the loss per spread is $6.47 ($647 in actual losses per spread). |

How Did the Trade Actually Perform?

You know how to determine the profitability of a short put spread at expiration, but how do these spreads perform when the stock price changes before expiration?

Let's take a look at how this short NFLX put spread performed:

When the 145 / 135 short put spread was initially sold for $3.53, NFLX shares were trading for nearly $147.

Over the first couple weeks of the trade (between 46 to 28 days to expiration), NFLX shares sold off to about $140, and the short put spread value expanded to $5.00. As a result, the bull put spread trader had approximately $147 in losses per spread ($3.53 Put Spread Sale Price - $5.00 Current Spread Price) x $100 Option Contract Multiplier = -$147 .

Fortunately, NFLX shares surged from $140 all the way up to $160, and the stock price was trading at $157.02 at the time of the short put spread's expiration date.

It's clear to see that the increase in the stock price resulted in a swift decrease in the price of the 145 / 135 short put spread, as the put options became substantially out-of-the-money (OTM).

With NFLX shares at $157.02 at expiration, the short 145 put and long 135 put both expired worthless, which means the value of the 145 / 135 put spread was $0.00. With an initial sale price of $3.53, the profit on the trade is $353 per short put spread:

($3.53 Put Spread Sale Price - $0.00 Spread Expiration Value) x $100 Option Contract Multiplier = +$353 Total Profit Per Spread .

Bull Put Spread

A bullish vertical spread constructed with put options: one short put and one long put at a lower strike price in the same expiration.

The maximum profit potential occurs when the stock price is above the short put's strike price at expiration, while the maximum loss potential occurs when the share price is below the long put's strike price at expiration.

In short, traders who sell put spreads want the stock price to rise or trade sideways as time passes, as both will result in the spread losing value over time (generating profits for the put spread seller).

To continue learning about this strategy, check out our ultimate guide on the bull put spread.

Time Decay & Vertical Spread Performance

How does time decay play a role in the profitability of vertical spread strategies?

Well, let's start with one law that applies to ALL call and put spreads:

To reach max profit, the extrinsic value of the options in the spread must reach $0.00.

Take a look at the following example:

Stock Price: $153.91

Spread: Long 150 / 152.5 Call Spread

Spread Price: $1.68

Maximum Spread Value: $2.50 (Width of Call Spread Strikes)

As we can see, the stock price is well above the short call's strike price of $152.50, but the 150 / 152.5 call vertical spread is only worth $1.68.

If the stock price is still $153.91 at expiration, we know that the 150 / 152.5 call spread will be worth $2.50, so why is the spread only $1.68?

The answer is that both options have extrinsic value remaining:

| Stock Price: $153.91 | ||

|---|---|---|

| Option | Option Price | Intrinsic & Extrinsic* |

| 150 Call | $5.88 | $3.91 Intrinsic $1.97 Extrinsic |

| 152.5 Call | $4.20 | $1.41 Intrinsic $2.79 Extrinsic |

*Intrinsic Value = Stock Price - Call Strike Price

*Extrinsic Value = Call Price - Intrinsic Value

If you look carefully, you'll notice that the value of the spread is $2.50 when only including the intrinsic value of each option:

Long 150 Call: $3.91 of Intrinsic Value

Short 152.5 Call: $1.41 of Intrinsic Value

Long Call Spread Value (Intrinsic Only): $3.91 Long Call - $1.41 Short Call = $2.50

Pretty cool, right?

Now, how does time decay come into the equation?

Well, the extrinsic value of all options decays away as time passes.

Knowing this, here's exactly what you want to happen when you trade each of the four vertical spreads:

Bull Call Spread: Stock price increases to a level equal to or greater than the short call's strike price while each option's extrinsic value decays away as time passes.

Bull Put Spread: Stock price increases/remains above the short put's strike price as time passes (as the spread's value will approach $0 as the extrinsic value of each put option melts away).

Bear Call Spread: Stock price decreases/remains below the short call's strike price as time passes (as the spread's value will approach $0 as the extrinsic value of each call option diminishes).

Bear Put Spread: Stock price falls to a level equal to or below the short put's strike price while the extrinsic value of each put option decays as time passes.

Time Decay & Vertical Spreads

For a vertical spread to reach the maximum profit level, the extrinsic value of the options in the spread needs to reach $0, which happens with the passage of time and favorable movements in the stock price.

Implied Volatility & Vertical Spread Performance

As always, implied volatility (the prices of options) plays a huge role in every options trading strategy. So, how does implied volatility play a role in the profitability of the four strategies discussed in this guide?

Here's how:

Implied volatility measures how much extrinsic value is being priced into a stock's options:

More "Expensive" Options ➜ Higher Implied Volatility/ More Extrinsic Value

Less "Expensive" Options ➜ Lower Implied Volatility / Less Extrinsic Value

In the last section, you learned that vertical spreads can only reach max profit if the extrinsic value in the spread reaches $0. With that said, you want implied volatility (option prices / extrinsic value) to decrease as the stock price is moving in favor of your spread.

Many sources will tell you that you want to buy vertical spreads when implied volatility is low, as you'll benefit from an increase in implied volatility.

This is partially incorrect.

If implied volatility increases (with all else being equal), that's an indication that traders have bid up the option prices and therefore they have more extrinsic value.

If implied volatility increases and the stock price is moving in your favor, you'll have less profits than you would if implied volatility had decreased.

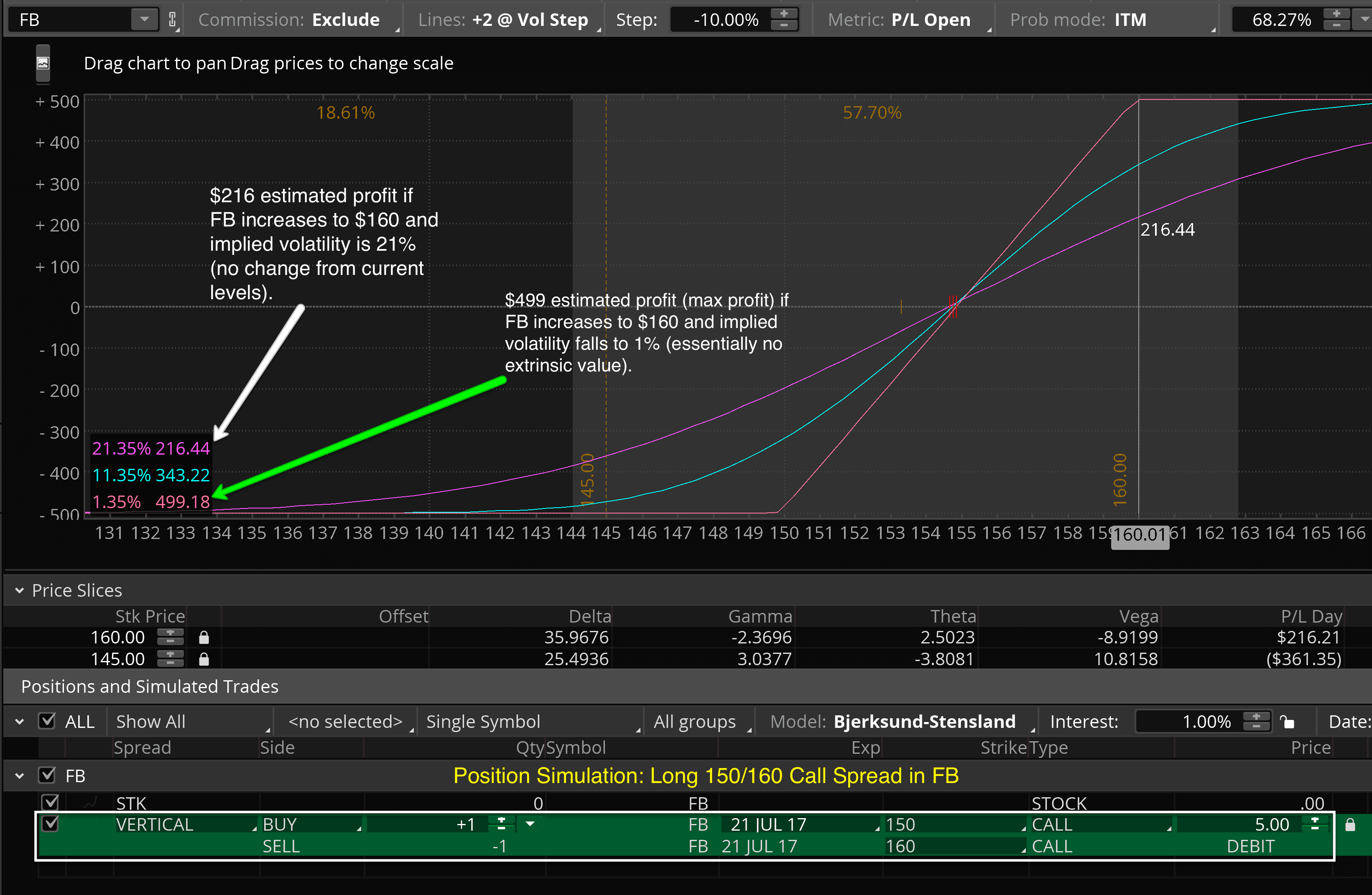

Consider the following example that estimates the P/L of a long 150/160 call spread in FB based on various implied volatility levels with FB rising to $160:

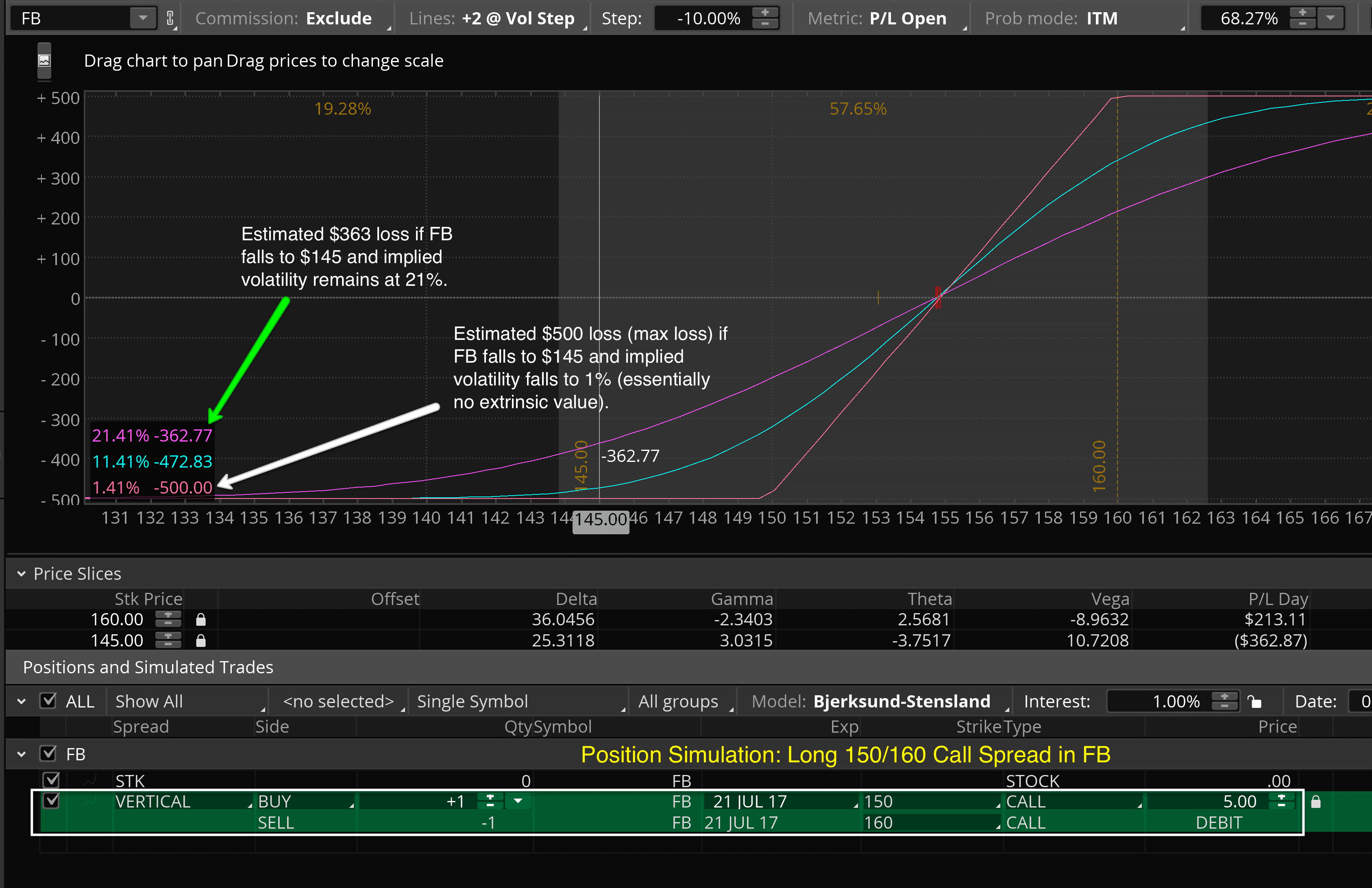

However, the one time you'll benefit from an increase in implied volatility (more extrinsic value) when trading vertical spreads is when the stock price moves against you. For example, if you buy a call spread and the stock price falls, you'll be better off if implied volatility increases while the stock is falling:

As we can see, the long call spread will have larger losses if FB implied volatility falls while the stock price is falling. However, if implied volatility remains the same or increases, the losses on the spread will be less severe.

Ok, we've covered some heavy content here, so let's break down the key takeaways from this section as they apply to each vertical spread:

✓ When buying call spreads or selling put spreads, you want the stock price to increase while implied volatility falls (as both will lead to less extrinsic value in the spreads). Fortunately, a implied volatility typically falls as the price of the shares rise.

✓ When buying put spreads or selling call spreads, you want the stock price to decrease while implied volatility falls (as both will lead to less extrinsic value in the spreads). Unfortunately, implied volatility usually increases when the price of the shares fall. As a result, the profits from a stock price decrease may be offset by an increase in implied volatility.

Implied Volatility & Vertical Spreads

Implied volatility represents how much extrinsic value exists in a stock's option prices.

Since vertical spreads require a decrease in extrinsic value to reach the maximum profit potential, you want implied volatility to decrease as the stock price is moving in favor of your spread.

However, if the stock price moves unfavorably, an increase in implied volatility (extrinsic value) will result in less severe losses.

The "Perfect Storm" for Vertical Spreads

Ok, so you know how time decay and implied volatility play a role in the performance of vertical spreads.

Let's put all of the concepts together and describe the "perfect storm" for profitable spread trading (generally speaking):

| Strategy | Favorable Change in the Stock Price | Favorable Change in Implied Volatility |

|---|---|---|

| Bull Call Spread | Increase | Decrease |

| Bull Put Spread | ||

| Bear Call Spread | Decrease | |

| Bear Put Spread |

In the above cases, the passage of time is a benefit, as extrinsic value decreases as expiration gets closer.

Choosing an Expiration Cycle

With so many different expiration cycles to choose from, which one should you trade?

Since vertical spreads can only achieve the maximum profit potential if the extrinsic value in the spread reaches $0, trading expiration cycles with less than 60 days to expiration is common.

Here's how the expiration you trade will impact the performance of each vertical spread (assuming you're comparing similar spreads in different expirations):

Favorable Stock Price Change: Short-term spread rises in value more than the same spread in a longer-term expiration cycle.

Unfavorable Stock Price Change: Short-term spread loses more value than the same spread in a longer-term expiration cycle.

In other words, when you're correct about a stock's price movements (e.g. you buy a call spread and the stock price increases), trading a shorter-term expiration cycle will result in quicker profits relative to the same spread in a longer-term expiration cycle.

On the other hand, when you're wrong about a stock's price movements (e.g. you sell a put spread and the share price falls), trading a shorter-term expiration cycle will result in larger losses relative to the same spread in a longer-term expiration cycle.

Let's take a look at some real call spread trades in NFLX to demonstrate these concepts.

Expiration Comparison: NFLX Call Spreads

To demonstrate the differences between trading shorter-term and longer-term spreads, let's look at some bull call spreads in NFLX from 2017.

Here are the trade details:

Entry Date: April 3rd, 2017

Stock Price at Entry: $146.92

Trade #1: Buy the May17 140/160 Call Spread for $8.74 (46 Days to Expiration)

Trade #2: Buy the Jun17 140/160 Call Spread for $8.95 (74 Days to Expiration)

In this case, we're comparing the same call spread (buy the 140 call, sell the 160 call) in two different expiration cycles.

Let's see how each spread performs as NFLX fluctuates over the next 45 days:

As we can see, both spreads move with each other, as they are constructed with the same options.

However, when NFLX takes a dip to $140 in the first two weeks, we can see that the May17 call spread has lost more money than the longer-term, Jun17 call spread.

When NFLX shares traded up to $160, we can see that the 140/160 call spread in the May17 expiration cycle was up over $1,000 at the highest point. However, at that time, the 140/160 call spread in the Jun17 expiration cycle was up only $700.

Since the June call spread has more time until expiration relative to the May call spread, the June call spread has much more extrinsic value remaining. As a result, the June call spread requires more time to pass before the spread's value can increase to a price similar to the shorter-term May call spread with very little extrinsic value.

The Time to Expiration "Sweet Spot"

So, should you choose a longer-term or shorter-term expiration cycle when trading vertical spreads?

Like many things in options trading, there isn't one perfect answer. However, there is a "sweet spot" you can use to balance the amount of time you have for your directional bias to play out, as well as the decay of extrinsic value if you're right about the stock's direction.

What's the sweet spot?

Anywhere between 30-60 days to expiration is quite common for most options strategies (including vertical spreads), as you get a great balance of time decay (which helps you if your directional outlook is correct), but also adequate time for your trade to recover if the stock moves against you initially.

Choosing an Expiration

When choosing an expiration cycle to trade, keep in mind that shorter-term expiration cycles will be more beneficial to trade if the stock price moves favorably during the time the trade is held. The reason is that shorter-term options have less extrinsic value, and therefore vertical spreads can achieve their maximum profit levels much quicker than longer-term spreads.

However, if the stock price moves unfavorably during the time the trade is held, trading a spread in a longer-term expiration cycle will be more beneficial, as longer-term options have more extrinsic value.

In general, trading options with 30-60 days to expiration is common.

Selecting Strike Prices

Selecting strike prices for vertical spreads is a very subjective process, and depends largely on two factors:

✓ The strategy you're using

✓ Your outlook for the stock

Let's dive in and discuss each factor.

Strike Price Selection: Debit Spreads

Of the four option strategies discussed in this guide, two of them are "debit" spreads, which means you pay to enter the spread because the option you buy is more expensive than the option you sell.

The two debit spread strategies are the bull call spread (buy a call and sell another call at a higher strike price) and the bear put spread (buy a put and sell another put at a lower strike price).

There are two general methods of selecting strike prices for debit spreads that we'll discuss in the next sections.

Buy In-the-Money, Sell Out-of-the-Money

When trading either of these strategies, it's very common to structure the trade like the following:

✓ Buy an in-the-money (ITM) option

✓ Sell an out-of-the-money (OTM) option

The reason for this is that the option you buy has intrinsic value, which means the option has less exposure to time decay. On the other hand, the option you sell is 100% extrinsic value, which is ideal because when you sell an option you want it to expire worthless.

Let's look at a debit spread structured in this manner and determine why many traders prefer this type of strike price selection:

| Stock Price | Spread | Spread Price |

|---|---|---|

| $153.82 | Long 160/150 Put Spread | $5.38 |

As we can see, the long 160 put is in-the-money, while the short 150 put is out-of-the-money. With the stock price at $153.82, the long 160 put has $6.18 of intrinsic value ($160 Put Strike Price - $153.82 Stock Price = $6.18).

Here's why it's important:

If the stock price remains at $153.82 through expiration, the 160 put will be worth $6.18, while the 150 put will expire worthless. With an initial spread purchase price of $5.38, the profit would be $80 per spread without the stock price changing at all.

Buy ITM, Sell OTM

When buying in-the-money strikes and selling out-of-the-money strikes, it's possible to structure vertical spreads so that the stock price doesn't have to change for the position to be profitable at expiration (in other words, it's a high-probability trade).

The downside is that buying ITM options results in a more expensive spread, which means there's more loss potential compared to buying a vertical spread with OTM options.

Buy All Out-of-the-Money Options

When a trader's directional outlook for a stock is more aggressive, they may buy vertical spreads with options that are entirely out-of-the-money (OTM).

Here's an example:

| Stock Price | Spread | Spread Price |

|---|---|---|

| $153.82 | Long 150/145 Put Spread | $1.00 |

In this case, the long 150/145 put spread is entirely OTM, which means the spread will be worthless at expiration if the stock price does not fall below $150.

Structuring a debit spread in this manner is much more aggressive, as you need the stock price to move favorably (and fast) to make money on the trade. This makes buying OTM spreads a lower probability trade.

However, the benefit of buying OTM vertical spreads is that you pay less for the spread because it has a lower probability of making money, which means you have less risk and more profit potential compared to the prior setup of buying an ITM option and selling an OTM option:

| Stock Price: $153.82 | ||

|---|---|---|

| Spread | Spread Price | Profit / Loss Potential |

| 150/145 Put Spread | $1.00 | +$400 / -$100 |

| 160/150 Put Spread | $5.38 | +$462 / -$538 |

When comparing the two debit spreads, it's clear to see that the downside of buying an ITM option and selling an OTM option carries more risk relative to the potential reward than buying an OTM debit spread.

However, as mentioned previously, the long 160/150 put spread can make money even if the stock price doesn't change, while the long 150/145 put spread requires the stock price to fall $4.82 to reach the trade's breakeven price.

Buying OTM Spreads

Choosing OTM strike prices when buying vertical spreads is a much more aggressive way to trade. When buying fully OTM spreads, the position will expire worthless if the stock price does not move favorably by expiration (in other words, it's a low-probability trade).

However, the benefit of buying an OTM spread is that the trade will not be as expensive as the ITM/OTM approach. As a result, the trade will have less risk relative to the profit potential.

The specific method used for selecting strike prices is up to each respective trader, but the key is to find a balance between the outlook for the stock (aggressive or more conservative) and risk/reward potential.

Strike Price Selection: Credit Spreads

The other two vertical spread strategies in this guide are the bear call spread and bull put spread. These spreads are considered "credit spreads" because the option you sell is more expensive than the option you purchase, which results in a "net credit" when selling the spread.

There are two common ways to choose strike prices for credit spreads:

✓ Sell an at-the-money (ATM) option

✓ Buy an out-of-the-money (OTM) option

This first method is more aggressive, as selling an ATM spread leaves very little room for the stock to move against you.

Here's the second, perhaps more common approach to selecting strike prices when selling vertical spreads:

✓ Sell an OTM option

✓ Buy an even further OTM option

The above approach is much less aggressive because the stock price has room to move unfavorably. Let's dive into some examples!

Sell an ATM Option, Buy an OTM Option

For the following example, we'll look at a bear call spread that is structured with an at-the-money short call and an out-of-the-money long call. Remember, the best-case scenario for a bear call spread is that the stock price remains below the short call's strike price as time passes.

Let's take a look:

| Stock Price: $159.20 | ||

|---|---|---|

| Spread | Spread Price | Profit/Loss Potential |

| 160/165 Call Spread | $2.05 | +$205 / -$295 |

As we can see, the short call's strike price of $160 is only $0.80 higher than the current stock price, which means the short call is essentially at-the-money.

If the stock price increases only slightly, the short call spread will be in-the-money, which is not the best-case scenario for the trade. However, we can see that the spread can make $205 if the stock price is below $160 at expiration, while the position will lose $295 if the stock price is above $165 at expiration.

Selling an At-the-Money Spread

When selling vertical spreads, traders with aggressive directional outlooks for a stock may sell an at-the-money spread, which consists of selling an at-the-money option and purchasing an out-of-the-money option.

The downside to this approach is that the stock price does not have much room to move against the trader's position, as even a small unfavorable change in the stock price will leave the spread in-the-money.

Sell an OTM Option, Buy a Further OTM Option

A less aggressive way to structure a short vertical spread is to sell an OTM option and purchase an even further OTM option.

Let's look at an example of another bear call spread on the same stock from the previous example:

| Stock Price: $159.20 | ||

|---|---|---|

| Spread | Spread Price | Profit/Loss Potential |

| 170/175 Call Spread | $1.00 | +$100 / -$400 |

As we can see, both options of this call spread are more than $10 out-of-the-money.

Here's why it matters:

In the previous example, the stock price only had to increase $0.80 before the short call spread was in-the-money. In this case, the stock price has to rise $10.80 before the 170/175 call spread is in-the-money.

The result? The trader has a much higher probability of making money on the trade because the stock price has to rise substantially more before the position gets into trouble.

Selling ATM vs. OTM Spreads

I know what you're thinking:

Why wouldn't I always sell a spread that is further out-of-the-money?

The answer is you'll have substantially more risk relative to potential profits. Let's compare three short call spreads as a demonstration:

| S tock Price: $159.20 | ||

|---|---|---|

| Spread | Spread Price | Profit/Loss Potential |

| 160/165 Call Spread | $2.05 | +$205 / -$295 |

| 170/175 Call Spread | $1.00 | +$100 / -$400 |

| 180/185 Call Spread | $0.50 | +$50 / -$450 |

Now do you see the downside of selling further OTM spreads?

Options that are further and further OTM are more likely to expire worthless, which means traders aren't willing to pay much for them. That means traders who sell those options won't collect a lot of premium for selling them.

So, when selling vertical spreads, it's important to strike a balance between:

✓ Your directional outlook for the stock price (aggressive or conservative)

✓ Risk/reward potential for selling that spread (which stems from the probability of that spread expiring OTM).

Selling OTM vs. ATM Spreads

The decision to sell an at-the-money vertical spread vs. an out-of-the-money depends on the aggressiveness of a trader's outlook for a stock's price in the future:

Aggressive Directional Outlook: Sell an at-the-money spread for more profit potential and less risk. However, the trade will have a lower probability of making money because there's not much room for the stock price to move against you.

Conservative Directional Outlook: Sell an out-of-the-money spread to allow more room for the stock to move against you before the spread becomes in-the-money. Since this approach has a higher probability of making money, the trade will have less profit potential and more loss potential relative to selling an at-the-money spread.

When to Take Profits & Losses

Pat yourself on the back for making it this far. You now know the most important mechanics of the four vertical spread strategies.

Now that you know the essential mechanics of each strategy, it's time to get a little more practical and talk about when to take profits and losses when trading these spreads.

Taking Profits: Use Risk/Reward Analysis

Unlike buying call options or put options, all vertical spread strategies have limited profit potential.

The limited-profit nature of these strategies makes it much easier to determine appropriate times for taking profits.

Let's use an example to illustrate why.

The following chart shows the performance of a bull call spread (long 120 call, short 130 call) on a stock that is trading near $127 at the time of entry:

45 to 39 Days to Expiration:

Fortunately, the stock price rises above the short call's strike price of $130 in the first few days, and the call spread has profits. Around 39 days to expiration, the call spread is trading for $6.00, which means the trader who bought the spread for $5.40 has $60 in unrealized profits per spread.

Since the call spread is fully in-the-money and the spread still has $4.00 left to gain, the trader in this scenario might continue holding the spread. Whether or not the trader takes profits is up to him/her, but it's good to know that there's still plenty of potential reward to be made if they decide to hold the position.

28 Days to Expiration:

Now, around 28 days to expiration, the stock price is just below $140, which means the 120/130 call spread is in-the-money by a significant amount. As a result of the stock price increase and passage of time (less extrinsic value), the 120/130 call spread is worth about $9.00. At this point in time, a trader who bought the spread for $5.40 is up $360 out of the possible $460 they can make.

With just $100 left to gain (the spread's price increasing from $9 to $10) and $900 to lose (the spread's price falling from $9 to $0), the most logical decision would be to close the trade and take profits by selling the call spreads.

Taking Profits

When buying vertical spreads (bull call spread or bear put spread), it becomes more logical to take profits on the trade when the spread gets closer to its maximum value. The reason is that there's less profit to make and more to lose as the spread's value increases.

When selling vertical spreads (bear call spread or bull put spread), it becomes more logical to take profits on the trade when the spread price approaches $0. Same as above, the reason is that there's less profit to make and more to lose as the spread's value decreases.

Taking Losses: Use Risk/Reward Analysis

What about taking losses? Should vertical spreads be closed at a certain point for losses?

Since all vertical spread strategies have defined risk (limited loss potential), losing trades actually have better risk/reward profiles than when the trades are entered.

Let's look at a bull put spread example that almost reaches the maximum loss potential before expiration. The trade we'll visualize is a 140/135 bull put spread (sell the 140 put, buy the 135 put) that is sold for $1.66:

6 Days to Expiration:

As we can see, this short put spread trade never had any profits, as the stock price collapsed through the spread right out of the gates.

At around 6 days to expiration, the 140/135 put spread was trading for around $4.40. With an initial sale price of $1.66, the loss at the time would be $274 per spread. However, since the spread can only be worth as much as $5, the maximum loss potential is $334.

With that said, the hypothetical trader in this example can only lose another $60 on the position, but can make $440 from the current loss level if the stock rallies and the put spread expires worthless.

The Takeaway:

When trading vertical spreads, it becomes more favorable from a risk/reward standpoint to hold losing trades that are near the maximum loss.

With that said, if a trader is going to take losses on a vertical spread position, then doing so would make sense well before the spread gets close to the maximum loss potential.

Taking Losses

When buying vertical spreads (bull call spread or bear put spread), it becomes less logical to close the trade and take losses the closer the spread gets to $0. The reason is that there's very little left to lose on the trade, but everything to gain.

When selling vertical spreads (bear call spread or bull put spread), it becomes less logical to take losses on the trade the closer the spread's price gets to its maximum potential value. Same as above, a short vertical spread that's reached a price close to the maximum value has very little left to lose, but still has the potential to make back all of the losses in addition to profits.

The above points do not mean traders should not take losses on vertical spreads, but there is a point in which doing so isn't as logical.

Copyright 2021 by projectoption.

How To Spread A Blog

Source: https://www.projectoption.com/vertical-spreads-explained/

Posted by: domingonathe1986.blogspot.com

0 Response to "How To Spread A Blog"

Post a Comment